On June 10, 2014, the Company agreed to amend and add certain terms to unsecured, non-interest bearing, due on demand notes payable issued to The Cellular Connection Ltd. during the period from February 22, 2013 to June 10, 2014 with a total carrying value $42,189. The issue price of the Note is $42,189 with a face value of $54,193 and the Note has an original maturity date of December 31, 2014 which is subject to automatic renewal. At the option of the Company, the Company may convert principal and interest at a fixed conversion price of $0.0001 per share of the Company’s common stock. The Note allows for the lender to secure a portion of the Company assets up to 200% of the face value of the Note. The outstanding face value of the Note shall increase by another 20% on January 1, 2020 and again on each one year anniversary of the Note until the Note has been paid in full. During the three months ended March 31, 2019, the Company elected to convert $900 of principal and interest into 9,000,000 shares of common stock of the Company at a fixed conversion prices of $0.0001 per share. This conversion resulted in a loss on debt settlement of $737,100 due to the requirement to record the share issuance at fair value on the date the shares were issued. The condensed consolidated statement of operations includes interest expense of $586 and $722 for the three months ended March 31, 2019 and 2018, respectively. At March 31, 2019 and December 31, 2018, the carrying amount of the Note is $11,578 (face value of $13,370 less $1,792 unamortized discount) and $11,892 (face value of $11,892 less $0 unamortized discount), respectively.

05/14/2019 (Two Hands Corp)

On January 31, 2019, the Company entered into a Side Letter Agreement (“Note”) with Stuart Turk to amend and add certain terms to unsecured, non-interest bearing, due on demand notes payable totaling $106,968 issued by the Company during the period of January 3, 2018 to December 28, 2018. The issue price of the Note is $106,968 with a face value of $128,362 and the Note has an original maturity date of December 31, 2019 which is subject to automatic renewal. At the option of the Company, the Company may convert principal and interest at a fixed conversion price of $0.0001 per share of the Company’s common stock. The Note allows for the lender to secure a portion of the Company assets up to 200% of the face value of the Note. If the Note is not paid on the maturity date, the outstanding face amount of the Note shall increase by 20% on January 1, 2020. The outstanding face value of the Note shall increase by another 20% on January 1, 2021 and again on each one year anniversary of the Note until the Note has been paid in full. The condensed consolidated statement of operations includes interest expense of $3,779 and $0 for the three months ended March 31, 2019 and 2018, respectively. At March 31, 2019 and December 31, 2018, the carrying amount of the Note is $110,747 (face value of $128,362 less $17,615 unamortized discount) and $0, respectively.

05/14/2019 (Two Hands Corp)

On January 31, 2019, the Company entered into a Side Letter Agreement (“Note”) with Stuart Turk to amend and add certain terms to the unsecured, non-interest bearing, due on demand notes payable totaling $106,968 issued by the Company during the period of January 3, 2018 to December 28, 2018. The issue price of the Note is $106,968 with a face value of $128,362 and the Note has an original maturity date of December 31, 2019 which is subject to automatic renewal. At the option of the Company, the Company may convert principal and interest at a fixed conversion price of $0.0001 per share of the Company’s common stock. The Note allows for the lender to secure a portion of the Company assets up to 200% of the face value of the Note. If the Note is not paid on the maturity date, the outstanding face amount of the Note shall increase by 20% on January 1, 2020. The outstanding face value of the Note shall increase by another 20% on January 1, 2021 and again on each one-year anniversary of the Note until the Note has been paid in full.

05/14/2019 (Two Hands Corp)

●The term of Notes is 60 months from the date of issuance. ●Fixed interest rate of 8% per annum, payable monthly. ●Early redemption request available after 1 month, without any penalty, subject to 90 days’ notice. The Company will accept such early redemption request subject to cash availability and business operations. ●Prior to maturity, the Noteholder must deliver a 90-day notice, or it will be subject to automatic renewal. ●The Company may call the Note prior to maturity in whole or in part, at any time or from time to time.

04/12/2021 (PFG Fund V, LLC)

(a) Automatic Renewal. This Agreement shall be automatically extended for an unlimited number of one-year periods, unless on or before December31, 2018 (for the initial term), or thereafter on or before the December31stthat is twenty-four (24) months before the expiration of any extended term, either Party provides to the other written notice of its desire not to automatically renew this Agreement.

03/29/2019 (OGLETHORPE POWER CORP)

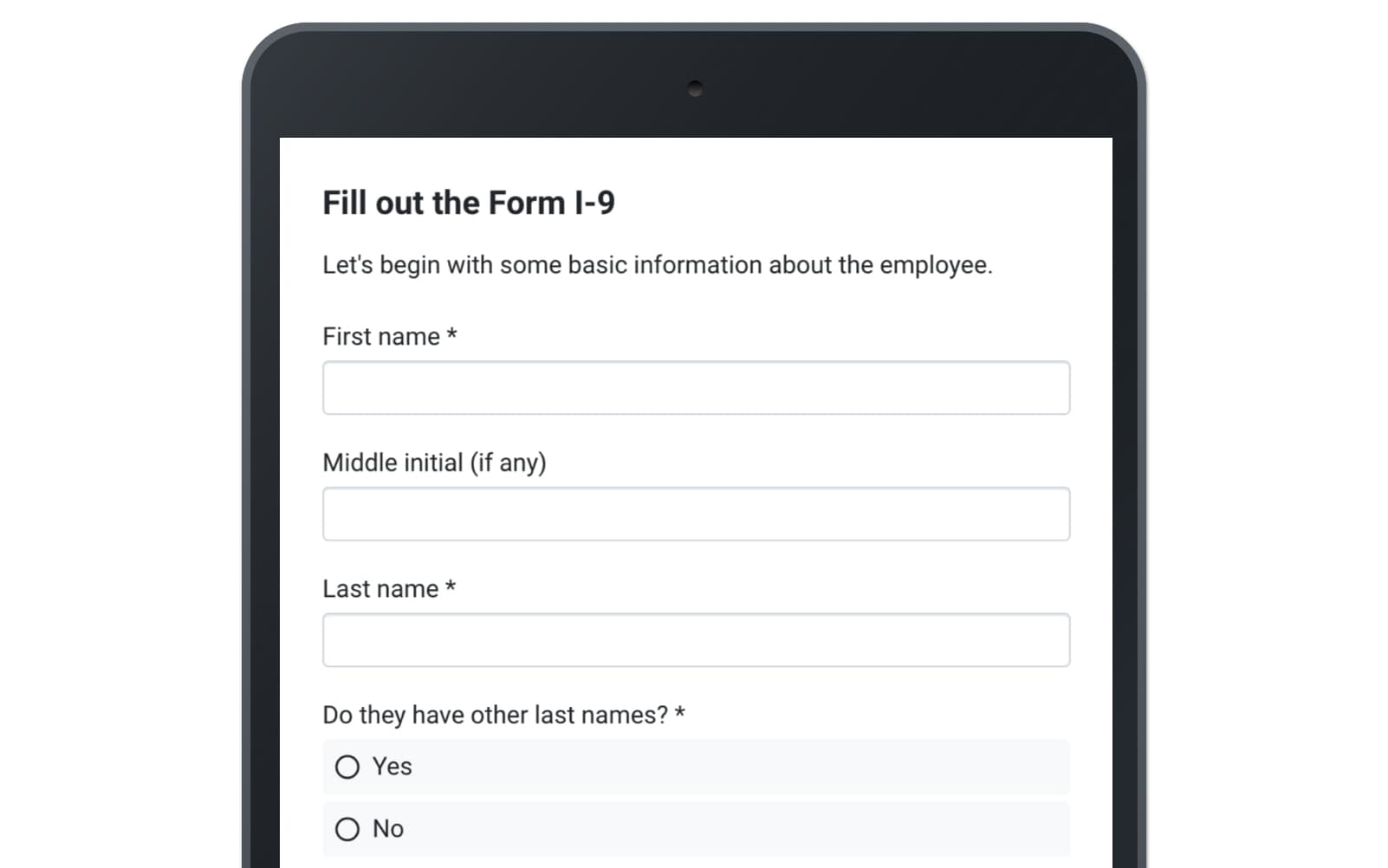

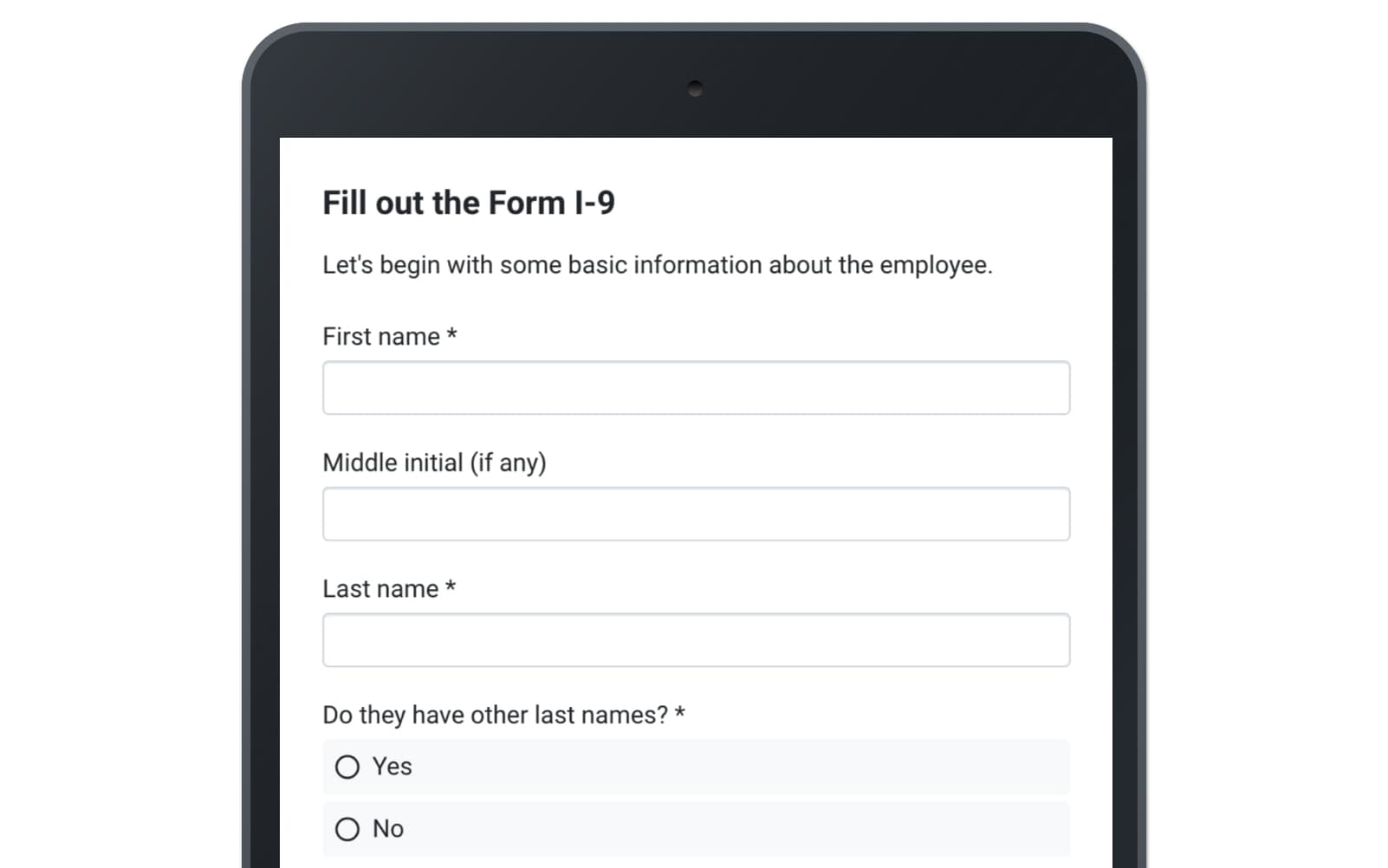

Build document automations that allow you, your staff, and your clients to auto-populate contract templates.

“ I've found it very easy to use. It allows me to work quickly, get something straight from my head and out into the public.”

Partner, Siskind Susser PC